If you import or export goods, you’ve likely come across the terms DDP and DAP shipping. These are Incoterms® used to define who handles costs, responsibilities, and risks during international shipping. Understanding DDP vs DAP shipping is essential for avoiding unexpected fees, delivery delays, and frustrated customers. In this guide, we break down each term clearly so you can choose the right option for your shipments.

What Does DDP Mean?

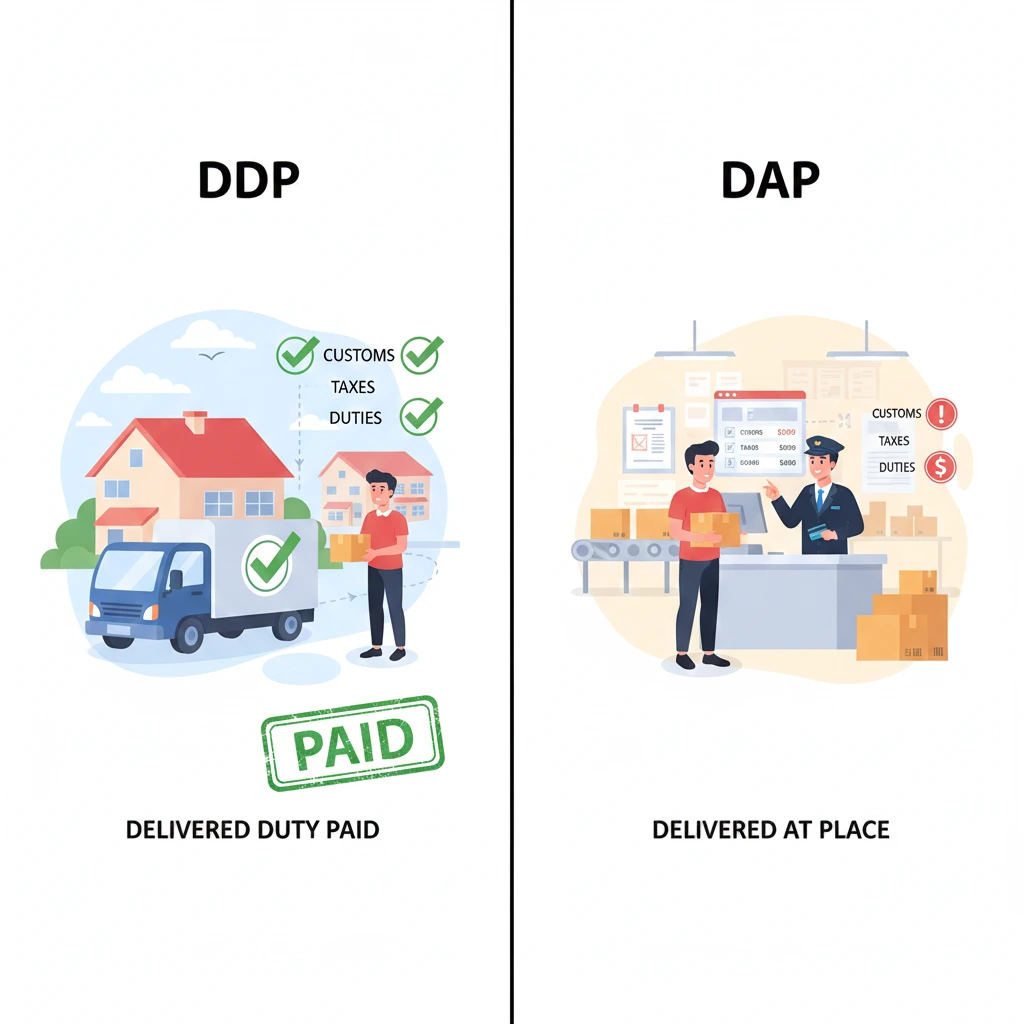

DDP (Delivered Duty Paid) is a shipping term that places maximum responsibility on the seller. Under DDP shipping, the seller is responsible for:

- Export customs

- Shipping and freight

- Import duties and taxes

- Customs clearance

- Final delivery to the buyer

In simple terms, DDP shipping means the seller handles every part of the shipping process until the product reaches the buyer’s door.

When to Use DDP

DDP is ideal when the seller has strong logistics experience or wants to offer a seamless buying experience. It is commonly used in eCommerce, global wholesale, and dropshipping.

Pros of DDP Shipping

- Buyer has zero import responsibilities

- Predictable total landing cost

- Reduced delays at customs

Cons of DDP Shipping

- Seller must know import rules for the buyer’s country

- Higher upfront costs for the seller

- Incorrect declarations can create legal issues

What Does DAP Mean?

DAP (Delivered At Place) means the seller ships the goods to an agreed location, but the buyer is responsible for import duties, taxes, and customs clearance.

Under DAP shipping, the seller covers:

- Export customs

- Shipping and freight

- Transport to the delivery location

The buyer covers:

- Import duties

- VAT or GST

- Customs clearance fees

When to Use DAP

DAP is ideal when the buyer is familiar with their local customs regulations and prefers to control the import process.

Pros of DAP Shipping

- Lower cost for the seller

- Buyer can choose their customs broker

- Reduced risk for exporters

Cons of DAP Shipping

- Buyers may face surprise import taxes

- Customs delays are more common

- Buyers may not fully understand import requirements

DDP vs DAP Shipping – The Key Differences

Understanding the difference between DDP vs DAP shipping comes down to responsibility and cost.

1. Who Pays Import Duties?

- DDP: The seller pays import duties

- DAP: The buyer pays import duties

This is the biggest difference and the one that most directly affects the customer experience.

2. Who Handles Customs Clearance?

- DDP: The seller handles import customs clearance

- DAP: The buyer must clear customs

3. Who Bears the Risk?

Risk shifts at different points depending on the Incoterm.

- DDP: Seller holds risk until final delivery

- DAP: Seller holds risk until the goods reach the agreed location (before customs clearance)

4. Who Has the Most Control?

- DDP: Seller controls the entire shipping process

- DAP: Buyer controls the import process

5. Cost Differences

DDP is usually more expensive because the seller pays duties and taxes.

DAP is usually cheaper for the seller but may be more expensive for the buyer at delivery.

Table: DDP vs DAP at a Glance

| Factor | DDP | DAP |

|---|---|---|

| Who pays import duties? | Seller | Buyer |

| Who clears customs? | Seller | Buyer |

| Final delivery | To buyer’s door | To agreed place (before customs) |

| Risk for seller | High | Medium |

| Cost for buyer | Higher upfront but predictable | Lower upfront but taxes at delivery |

Which Is Better: DDP or DAP?

Choosing between DDP vs DAP shipping depends on your role and priorities.

Best for Sellers

DDP shipping is better if you want to offer a frictionless buying experience—especially in global eCommerce. Customers prefer knowing the full cost upfront without surprise taxes.

Best for Buyers

DAP shipping is better if you prefer handling your own customs clearance or want to choose your own customs broker to reduce costs.

Common Problems with DDP Shipping

Although DDP offers convenience, it can also lead to challenges:

1. Restricted Carrier Policies

Some couriers have strict rules about third-party customs clearance, making DDP difficult.

2. Miscalculated Duties

If the seller miscalculates import taxes, they may face fines or delays.

3. Country Restrictions

Certain countries don’t allow DDP shipments due to local regulations.

Common Problems with DAP Shipping

DAP is more flexible for sellers, but buyers sometimes struggle with:

1. Surprise Duty Fees

Buyers may not know they must pay duties until the carrier requests payment.

2. Customs Delays

Incorrect paperwork or missing information can slow down delivery.

3. Customer Frustration

Online shoppers often dislike receiving a duty bill at their door.

How to Choose Between DDP and DAP for Your Business

Here’s a quick checklist to help you decide:

Choose DDP if:

- You want to offer a smooth customer experience

- You understand international tax rules

- You want fewer abandoned carts in eCommerce

- You ship to countries with predictable customs fees

Choose DAP if:

- Your buyer prefers handling customs

- You want to avoid high import taxes

- Your shipments are high-risk or bulky

- You’re unfamiliar with the buyer’s customs regulations

Final Thoughts: DDP vs DAP Shipping – Which One Is Right for You?

Both DDP and DAP shipping play important roles in international trade. The best choice depends on how much responsibility each party wants to take on. If you want to give your customers a stress-free, all-inclusive delivery, DDP shipping is the better option. But if your buyers prefer controlling customs or you want to avoid import complexities, DAP shipping is the smarter choice.

Leave a Reply